Introduction

Insurance fraud is no longer a sporadic operational challenge… it’s a multi-billion-dollar global threat affecting profitability, customer experience, and regulatory trust. As fraudulent schemes grow more sophisticated, traditional rule-based systems are struggling to keep up.

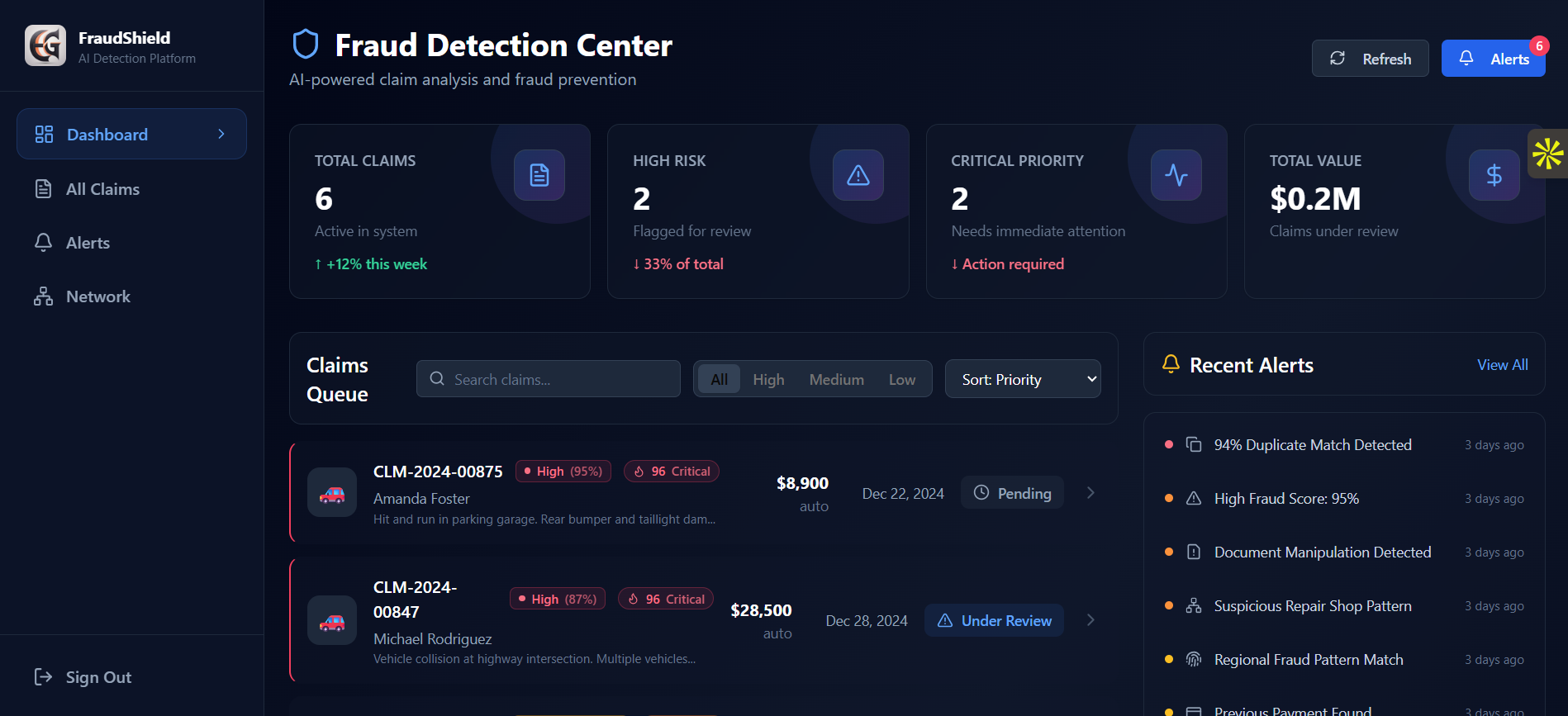

This is where AI-powered fraud detection steps in… offering unprecedented accuracy, automation, and scalability.

In this post, we’ll explore how modern insurers are leveraging AI to detect false claims, prevent duplicate payouts, and streamline investigation workflows with intelligent automation.

The Rising Challenge of Fraud in Insurance

According to industry studies, over 10–15% of all insurance claims involve some element of fraud—intentional or opportunistic. The biggest gaps occur in:

- False or exaggerated claims

- Duplicate claims across providers

- Double payments due to operational inefficiencies

- Document manipulation and synthetic identities

- Collusion between claimants and service providers

Legacy systems rely on manual checks or simple rules (e.g., “flag every claim above ₹X”). These methods fail in the era of organized fraud networks, deepfake documents, and automated scam attempts.

How AI Solves the Fraud Problem

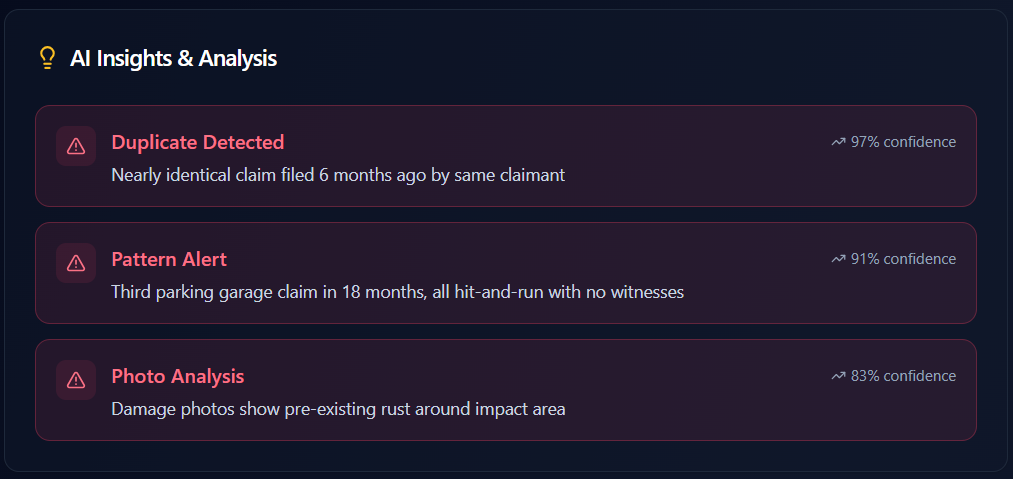

AI can analyze massive datasets, uncover hidden patterns, detect anomalies in real time, and automate tedious verification tasks that humans simply cannot scale to.

Here are the core AI capabilities transforming claims fraud prevention:

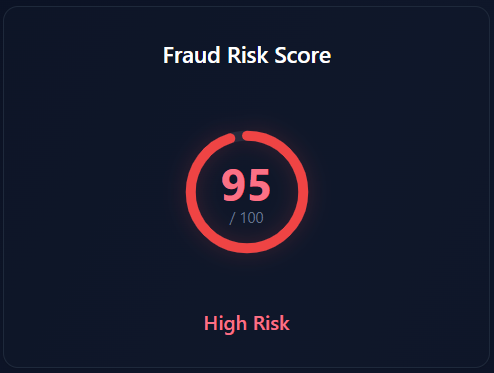

AI models use historical patterns, anomaly detection, and behavioral signals to assign each claim a Fraud Probability Score.

Factors analyzed include:

- Claimant’s prior claim history

- Geo-temporal patterns

- Document irregularities

- Similarities to known fraud cases

- Behavioral anomalies (frequency, timing, context)

This enables teams to prioritize investigation and automatically fast-track low-risk claims.

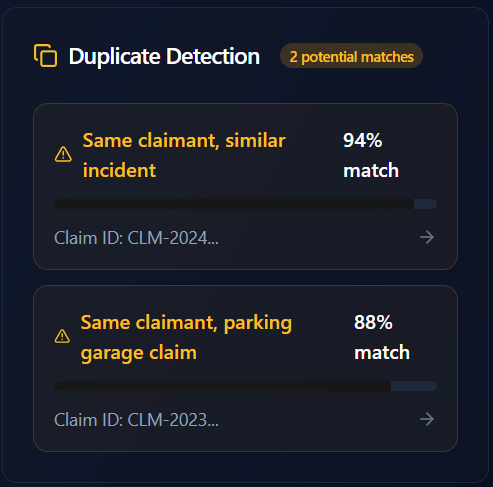

AI compares incoming claims across:

- Policy information

- Incident details

- Dates and timestamps

- Supporting documentation

- Repair shop and doctor networks

By using vector similarity, NLP, and entity-resolution models, insurers can flag:

- Multiple claims for the same incident

- Claims filed with multiple insurers

- Cross-channel fraud exploiting offline/online silos

This prevents huge financial leakage.

AI uses OCR, NLP, and computer vision to detect:

- Edited invoices

- Fake or manipulated PDFs

- Recycled or AI-generated photos

- Inconsistent metadata

The system cross-verifies documents with internal and external sources… automatically.

AI creates a consolidated view of:

- Claim lifecycle

- Payment history

- Adjuster notes

- Beneficiary data

Before any payout, the model checks for anomalies and blocks accidental duplicate transfers.

Graph-based AI models reveal fraud rings by connecting dots between:

- Claimants

- Workshops

- Hospitals

- Adjusters

- Geographic clusters

This helps detect organized fraud that rule-based systems always missed.

Real Business Benefits for Insurers

AI Fraud Detection is No Longer Optional

Modern fraud risks require modern defenses.

AI is not just a technological upgrade… it’s a strategic advantage that enables insurers to:

- Protect margins

- Improve customer trust

- Lower claim ratios

- Scale operations without scaling cost

Leading insurers globally are already adopting AI-based fraud analytics platforms… those who delay risk falling behind.

Conclusion

AI-powered fraud detection is reshaping the insurance landscape by bringing intelligence, automation, and real-time decision support into the claims workflow. With the rise of deepfakes, synthetic identities, and digital-first fraudsters, the move toward a proactive, AI-driven defense system has become both inevitable and essential.

Insurance companies that embrace this shift early will be the ones who lead the next decade of digital insurance transformation.